Landless and fighting, as ground beneath shifts

Some sections in Kerala are already blaming the land reform law for hurting big

industrial projects; meanwhile around 10,000 dalit and adivasi families are

locked in a struggle for the original entitlements that never came, reports

M Suchitra.

Insufficient relief for Kerala's endosulfan victims

For seven-year-old Sandhya and her siblings, totally dependant on their mother who ekes out a living by making beedis,

the state government's relief package, announced nearly 18 months ago, is simply not enough. Many more suffer the

same fate.

P N Venugopal

reports.

Illicit liquor brewing despair in Attappadi

In Attapady block of Kerala's Palakkad district, illicit liquor is taking a heavy toll among the adviasis. Addiction to the brew has led to many

deaths and suicides, even as a complacent and complicit administration looks on.

M Suchitra

reports.

State of Muslim education in Kerala

In Kerala, considered a role model for other parts of the country, almost all Muslim children up to the tenth standard are in school,

numbers that compare well to that of other communities. Yet, the story is very different when one looks at higher education, writes

Deepa A.

ASEAN trade agreement will hurt Kerala farmers

India's share in international trade has increased from 0.7 percent to 1

percent, which is a remarkable achievement, some say. In the meantime,

lakhs of farmers in Kerala are being adversely affected by reduction

of import tariffs on edible oils, spices and other cash crops.

Thomas Varghese

delves deeper.

The flavour of greed

With crop prices rising 30-fold, thousands of farmers in the hills of the south abandoned their traditional crops

and switched to vanilla, with bank loans and rumours fueling their already unrealistic hopes even higher.

But of course it was all too good to be true for very long.

N P Chekkutty

reports.

The next frontier in education

With a long history of support for public education, Kerala has led the nation's movement towards universal

literacy. But now, with the early challenges conquered, there are tough new lessons to be learned, to provide equitable,

quality education.

Deepa A

reports.

Suryanelli verdict : justice overturned?

The Suryanelli case involved a 16-year-old girl who was allegedly sexually harassed and assaulted continuously for 40 days by 42 men in 1996. A special court convicted 36 accused during 2000-2,

but the High Court of Kerala surprisingly overturned that verdict in January this year.

M Suchitra

reports.

Kerala sets new education course

Responding to reports of high stress among students and parents,

the state proposes to revise the grading system used in Class X.

Sreedevi Jacob

reports on the hopes and fears it has raised.

Pioneering school faces new obstacles

This 15-year-old school in Rajasthan has been providing quality education accessible to poor children. But going against the spirit of a High Court order, the Jaipur Development Authority has asked the Bandhyali school to pay a prohibitive sum for its allotted land.

Deepa A

reports.

Cry, my beloved school

A wide-cross section of academicians and civil society organisations have come together to express dissent at the threat of closure of a well known rural school in Bandhyali, Rajasthan. They are demanding that the government honour its own commitments to provide free, good education to all children, reports

Deepti Priya Mehrotra.

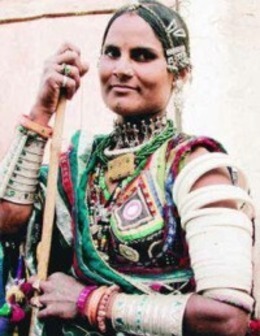

Vanishing people, vanishing livelihoods

Nomadic communities make up about 7 percent of India's population, but policy makers have largely ignored

them, says

Bahar Dutt.

M/S Anjani Broadband Pvt. Ltd vs M/S Lucky Airnet Pvt. Ltd on 8 May, 2020

2. The case of the plaintiff as disclosed from the plaint is that the plaintiff is engaged in the business of providing internet services under licence from Department of Telecommunications, Ministry of Communications & Information Technology. The defendants approached the plaintiff for taking internet services and after negotiations the plaintiff agreed to provide services to a defendant and thereafter the plaintiff and the defendant signed customer application form (CAF) on 04.04.2015. The plaintiff provided the internet services to a defendant No. 1 company on monthly basis and after providing the services, the plaintiff raised bill of Rs.27,54193/ and out of the said amount the defendants paid a sum of Rs. 22,08,000/ and the balance sum of Rs. 5,46,193/ is outstanding and due against the defendants which defendants failed to pay despite demands from the plaintiff.

Sh. Santosh Kumar Mittal vs M/S International Trading Agency on 8 May, 2020

1. The plaintiff has filed the present suit against the defendant for recovery of Rs. 2,72,858/. The brief facts of the present case are as under : 1.1 That the plaintiff is the proprietor of M/s S.K. Enterprises and doing the business of government electrical contractor since 1995.

1.2 That defendant No. 2 is known to the plaintiff for more than 20 years and defendant No. 2 was running his business of sale of electrical goods as proprietor/partner of defendant No. 1 for the last 7/8 years from the aforesaid address and presently doing the business from the top floor of the aforesaid address.

1.3 That in the first week of March, 2015 defendant No. 2 had requested for a friendly loan of Rs. 2,50,000/ from the plaintiff for some urgent business need for one week and considering the old friendship with defendant no. 2, the plaintiff had agreed to give a sum of Rs. 2,00,000/ to the defendants but defendant No. 2 was insisting to increase the amount from Rs. 2,00,000/ and accordingly, the plaintiff had agreed to give Rs. 2,01,000/ to the defendants as a friendly loan for one week to the defendant and transferred an amount of Rs. 2,01,000/ on 09.03.2015 by RTGS No. 17673 from the account of his firm M/s S.K. Enterprises Page 2 of 10 bearing No. 034902000001291 with Indian Overseas Bank, Roop Nagar, Delhi to the account of defendant No. 1 bearing No. 914020024386296 with Axis Bank, Mukherjee Nagar, Delhi having IFSC code No. UTIB0001838.

Cr No.-78/202 vs Ravi Shankar Kumar on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-78/2020 Page No.-1 of 3 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, noticing return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-83/202 vs Md Tamgid on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-83/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-89/202 vs Sunita Kanaujia on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-89/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-91/202 vs Anil Singh on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-91/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-85/202 vs Karan Singh on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-85/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-87/202 vs Inder Sain on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-87/2020 Page No.-1 of 3 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, noticing return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-93/202 vs Mohd. Ruhul Amin on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-93/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-84/202 vs Anamika Kumar on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed.

CR No.-84/2020 Page No.-1 of 3

3 Sh.Anish Bhola, counsel for the petitioner has assailed the impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, noticing return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-88/202 vs Marina Dass on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-88/2020 Page No.-1 of 3 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, noticing return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-86/202 vs Anant Nag Bhushan Sethy on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-86/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-95/202 vs Sandeep Kumar Khalia on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-95/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-97/202 vs Hiralal Ary on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-97/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-90/202 vs Ravi Kumar on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-90/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-92/202 vs Naveen on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-92/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-94/202 vs Ratish Kumar Mishra on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-94/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-96/202 vs Ajay Kumar on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-96/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Cr No.-98/202 vs Jitender Kumar Jha on 8 May, 2020

1.2 Notice to the respondent was dispensed with, as the respondent had not yet been summoned by the Trial Court.

2 A perusal of the impugned order reveals that the Ld. Trial Court declined to take cognizance of the complaint primarily for the reason that the complainant despite availing several opportunities had not filed the ECS mandate. Further the account statement filed did not bear any stamp and was not even signed. Therefore, noticing that several opportunities have already been afforded to the complainant, the complaint was dismissed. 3 Sh.Anish Bhola, counsel for the petitioner has assailed the CR No.-98/2020 Page No.-1 of 4 impugned Order on the ground that the Ld. MM committed a grave error in observing that the ECS mandate was not on record. It is pointed out that the petitioner/ complainant along with the complaint had placed on record a ' Debit Authorization Form issued by the customer" i.e. the respondent to the petitioner bank. It is argued that the Debit Authorization Form is akin to ECS mandate. . To link the Debit Authorization Form with the loan agreement involved, an account statement was placed on record. The petitioner/complainant had also placed on record along with the complaint a memorandum issued by the bank, intimating return of the mandate on account of insufficiency of funds. Sh.Bhola has, further, argued that the offence as envisaged u/sec.-25 of the Payments & Settlement Systems Act (hereinafter referred to as 'the PSS Act') was completed, when the respondent, who had taken a loan and had issued authorization to debit the amount each month from his account failed to maintain sufficient balance in his account, thereby, resulting in failure of debit of amount. It is, therefore, argued that the Ld. MM committed a grave error in dismissing the complaint as both the documents constituting the offence were on record.

Oberoi Paints Pvt. Ltd vs Unilec Engineers Ltd on 6 May, 2020

2. Relevant facts are that plaintiff has filed suit for recovery against the defendant no.1 and 2. The case of the plaintiff, as set out in the plaint, is that plaintiff is a company registered under the Companies Act 1956 and is engaged in the manufacturing of coating powder and trading of decorative and industrial paints and thinner since 1994. The defendant is a limited company and registered under the Companies Act, 1956 and involved in the manufacturing of electrical panels. The defendant through its directors/ officials approached the plaintiff for purchase of the coating powder and industrial paints and thinner and at the time of commencement of the business, the terms of business, as specifically printed on or contained in the plaintiff's invoices were agreed by the defendant and thereafter business dealings and transactions started between the parites hereto in 2004 and since 15.04.2004 they have been maintaining a running account.

Rustam Ansari vs The State Of Jharkhand on 7 May, 2020

---------

For the Appellants : Mr. Lukesh Kumar, Advocate For the State : Mr. Sardhu Mahto, A.P.P.

---------

th 04/Dated: 07 May, 2020

1. This interlocutory application has been filed under Section 389(1) of the Code of Criminal Procedure for suspension of the sentence and grant of ad-interim bail, to the petitioners, during the pendency of the appeal.

2. The petitioners/ appellants have been convicted for the offence under Sections 25(1-A), 26(2) read with Section 35 of the Arms Act by the court of learned Additional Judicial Commissioner, II, Ranchi, in Sessions Trial No.361 of 2016.

Nitish Kumar vs The State Of Jharkhand on 7 May, 2020

2. Amit Kumar Paswan @ Amit Kumar --- --- Petitioners Versus The State of Jharkhand --- --- Opposite Party

---

CORAM: Hon'ble Mr. Justice Aparesh Kumar Singh Through: Video Conferencing

---

For the Petitioners: Mr. Sujit Kr. Singh, Advocate For the State : Mr. Birendra Burman, A.P.P.

----

03/ 07.05.2020 Heard learned counsel for the petitioner and learned A.P.P for the State through Video Conferencing.

Jagat Mahato @ Jagat Mahato vs The State Of Jharkhand on 7 May, 2020

2. Karmu Mahato @ Karmu Mahto --- --- Petitioners Versus The State of Jharkhand --- --- Opposite Party

---

CORAM: Hon'ble Mr. Justice Aparesh Kumar Singh Through: Video Conferencing

---

For the Petitioners : Mr. Suraj Singh, Advocate For the State : Mr. Satish Kumar Keshri, A.P.P.

----

03/ 07.05.2020 Heard learned counsel for the petitioners and learned A.P.P through Video Conferencing.

Gulli Mandal @ Gurudeo Mandal vs The State Of Jharkhand on 7 May, 2020

-----

For the Petitioner : Mr. Kaushal Kishor Mishra, Advocate For the State : Mr. Ravi Prakash, A.P.P. -----

02/07.05.2020. The bail application of Gulli Mandal @ Gurudeo Mandal in connection with Cyber P.S. Case No. 08 of 2018 registered for the offences under Sections 419/420/467/468/471/120(B) of the Indian Penal Code and Sections 66(C) and 66(D) of the Information Technology Act, has been moved by Mr. Kaushal Kishor Mishra, learned counsel for the petitioner and opposed by Mr. Ravi Prakash, learned A.P.P. for the State, which has been conducted through Video Conferencing in view of the guidelines of the High Court taking into account the situation arising due to COVID-19 pandemic.

Md. Shamim @ Sotti vs The State Of Jharkhand on 7 May, 2020

-----

For the Petitioner : Mr. Rohan Mazumdar, Advocate For the State : Mr. Gouri Shankar Prasad, A.P.P. -----

02/07.05.2020. The bail application of Md. Shamim @ Sotti in connection with Jharia P.S. Case No. 499 of 2014, corresponding to G.R. No. 4917 of 2014 registered for the offences under Sections 25(1)(A)(B)(C) of the Arms Act, has been moved by Mr. Rohan Mazumdar, learned counsel for the petitioner and opposed by Mr. Gouri Shankar Prasad, learned A.P.P. for the State, which has been conducted through Video Conferencing in view of the guidelines of the High Court taking into account the situation arising due to COVID-19 pandemic.

Sanjay Kumar vs The State Of Jharkhand on 7 May, 2020

Learned counsel for the petitioner prays that defect no. 9 (ii) and (iv) which relates to page no. 19 of the petition may be ignored as page is otherwise legible and complete except the last line which is not of much significance. Accordingly, defect no. 9 (ii) and (iv) is ignored. So far defect no. 9(iii) is concerned which relates to non-filing of duly certified typed copy of handwritten pages at Annexure-2 & 3, in view of the submission made by learned counsel for the petitioner, it is also ignored.

2. Petitioner is an accused in connection with C.P. Case No. 96/2019 for the offences registered under sections 498(A) and 323 of the Indian Penal Code, pending in the Court of Miss Babita Mittal, learned Judicial Magistrate, 1st Class, Bokaro.

Tanvir Ahmad @ Sonu vs The State Of Jharkhand on 7 May, 2020

Learned counsel for the petitioner submits that the name of the petitioner and his alias name in the body of the petition tallies with his name in the complaint petition, Aadhar Card, impugned order and also in the body of vakalatnama except where petitioner has inscribed his signature. Therefore, the same may be ignored.

In view of the submission made, let the instant defect be ignored. Learned counsel for the petitioner, in present circumstances, undertakes to remove the remaining defect no. 9(ii) and (iii) regarding filing of certain pages within a week. Defect no. 9(v) is ignored as according to the learned counsel for the petitioner, last page of the restoration application is not of much relevance. Defect no. 9 (iv) is also ignored.

Pashupati Mahato vs The State Of Jharkhand on 7 May, 2020

2. Manoj Mahato @ Manoj Kr. Mahato

3. Mantu Mahato @ Mantu Lal Mahato

4. Kirtichand Mahato @ Kiriti Bhushan Mahato

5. Nem Chand Mahato

6. Gopal Mahato --- --- Petitioners Versus The State of Jharkhand --- --- Opposite Party

---

CORAM: Hon'ble Mr. Justice Aparesh Kumar Singh Through: Video Conferencing

---

For the Petitioners : Mr. Rakesh Kumar, Advocate For the State : Mr. Shiv Kumar Sharma, A.P.P.

Ranjit Kumar Sharma vs The State Of Jharkhand on 7 May, 2020

---------

For the Petitioner : Mr. Suraj Singh, Advocate For the State : Mr. P. K. Jaiswal, A.P.P.

---------

th 06/Dated: 07 May, 2020

1. Learned counsel for the petitioner submits that he shall file the requisites of notice under registered cover with A/D as well as under ordinary process, to be served upon O.P. No.02, at the earliest.

2. On prayer of learned counsel for the petitioner, office to list this case on 09.06.2020.

(AMITAV K. GUPTA, J.) Chandan/-

Arvind Nayak @ Arbind Nayak vs The State Of Jharkhand on 7 May, 2020

---------

For the Appellant : Mr. Gaurav, Advocate For the State : Mr. Shiv Shankar Kumar, A.P.P.

---------

th 05/Dated: 07 May, 2020

1. This interlocutory application has been filed under Section 389(1) of the Code of Criminal Procedure for suspension of the sentence and grant of ad-interim bail, to the petitioner, during the pendency of the appeal.

2. The petitioner/ appellant has been convicted for the offence under Sections 25(1-A)/35, 26(2)/35 of the Arms Act and Section 17(2) of Criminal Law Amendment Act by the court of learned Additional Sessions Judge - I, Simdega, in Sessions Trial No.131 of 2017.

Deepak Mahto vs The State Of Jharkhand on 7 May, 2020

---------

For the Petitioners : Mr. Birju Thakur, Advocate For the State : Mr. P. K. Jaiswal, A.P.P.

---------

02/Dated: 07th May, 2020

1. The petitioners have been made accused for the offence registered under Sections 323, 354(A), 354(B), 376, 511 and 34 of the Indian Penal Code.

2. Having heard learned counsel for the petitioners and learned A.PP and on perusal of the deposition of the victim, i.e., P.W. - 1, at Annexure - 2, it appears that during the trial, the victim has deposed that accused Bajrang along with three other accused had caught hold of her and she has identified Bajranj but has not identified the petitioners. In cross- examination she has categorically stated that the petitioners were not present at the time of occurrence.

Renu Devi & Ors vs The State Of Jharkhand on 7 May, 2020

---------

For the Petitioners : Ms. Shamma Parveen, Advocate For the State : Ms. Lily Sahay, A.P.P.

---------

th 02/Dated: 07 May, 2020

1. The petitioners have been made accused for the offence registered under Sections 370/ 366A of the Indian Penal Code.

2. Learned counsel for the petitioners is present.

3. Learned A.P.P., submits that case diary is required to assist this Court in the matter, hence prays for time to procure the case diary.

4. Heard. On prayer of learned A.P.P, office to list this case on 08.06.2020.

Jatin Kumar Manjhi @ Jatin Manjhi vs The State Of Jharkhand on 7 May, 2020

-----

For the Petitioner : Mr. Rohan Mazumdar, Advocate For the State : Mr. Arun Kumar Pandey, A.P.P.

-----

02/07.05.2020. The bail application of Jatin Kumar Manjhi @ Jatin Manjhi has been moved by Mr. Rohan Mazumdar, learned counsel for the petitioner and opposed by Mr. Arun Kumar Pandey, learned A.P.P. for the State, which has been conducted through Video Conferencing in view of the guidelines of the High Court taking into account the situation arising due to COVID-19 pandemic.

Lalu Kumar Rana @ Lalu Rana vs The State Of Jharkhand on 7 May, 2020

-----

For the Petitioner : Mr. Rahul Ranjan, Advocate For the State : Mr. Ravi Prakash, A.P.P.

-----

02/07.05.2020. The bail application of Lalu Kumar Rana @ Lalu Rana has been moved by Mr. Rahul Ranjan, learned counsel for the petitioner and opposed by Mr. Ravi Prakash, learned A.P.P. for the State, which has been conducted through Video Conferencing in view of the guidelines of the High Court taking into account the situation arising due to COVID-19 pandemic.

In view of the allegations, let the case diary and antecedent report of the petitioner be called for from the court concerned.

Umesh Choudhary vs The State Of Jharkhand on 7 May, 2020

-----

For the Petitioner : Mr. Suraj Singh, Advocate For the State : Mr. Hardeo Prasad Singh, A.P.P.

-----

02/07.05.2020. The bail application of Umesh Choudhary has been moved by Mr. Suraj Singh, learned counsel for the petitioner and opposed by Mr. Hardeo Prasad Singh, learned A.P.P. for the State, which has been conducted through Video Conferencing in view of the guidelines of the High Court taking into account the situation arising due to COVID-19 pandemic.

Mr. Suraj Singh, learned counsel for the petitioner submits that he will remove the defects when the physical appearance in the High Court will start.

Assay Ceramics & Chemicals Pvt. ... vs The State Of Jharkhand Through The ... on 6 May, 2020

2. Learned counsel for the petitioner undertakes to file the court fee as soon as the judicial work in the High Court gets normal after end of the lockdown prevailing due to Corona (Covid-19) pandemic.

3. The present writ petition has been preferred by the petitioner for quashing and setting aside the notice dated 17.04.2020 issued by the District Certificate Officer, Seraikella-Kharsawan (the respondent no.5) whereby the Director of the petitioner-company has been directed to show cause as to why he should not be committed to civil prison for not depositing the certificate amount. Further prayer has been made for quashing and setting aside the letter as contained in memo no. 667 dated 16.04.2020 issued by the Deputy Commissioner, Seraikella-Kharsawan (the respondent no. 3) directing the respondent no. 5 to immediately issue warrant of arrest against the Director of the petitioner-company and to take steps for attachment of its property. The petitioner has also prayed for setting aside the final order if any passed under Section 10 of the Bihar & Orissa Public Demand Recovery Act, 1914 (in short "the Act, 1914") and to restrain the respondent authorities from taking any precipitate action against the petitioner including suspension of its agreement for milling of rice. Learned counsel for the petitioner, in course of argument has also prayed for an interim protection from any action to be taken by the respondent authorities pursuant to the impugned notice dated 17.04.2020.

Upendra Kumar Singh vs The State Of Jharkhand on 6 May, 2020

2. Chitranjan Kumar Singh ...Opp. Parties CORAM: - HON'BLE MR. JUSTICE RAJESH SHANKAR For the Petitioner : - Mr. Manish Kumar, Advocate For the State :- Mrs. Laxmi Murmu, A.P.P.

06/06.05.2020 The present revision petition is taken up through Audio/Video conferencing.

Heard learned counsel for the petitioner as well as the learned A.P.P. appearing on behalf of the State of Jharkhand (opposite party no.1).

Admit.

Issue notice to the opposite party no. 2.

Bina Devi vs The State Of Jharkhand on 6 May, 2020

2. Kanthi Choudhary ...Opp. Parties CORAM: - HON'BLE MR. JUSTICE RAJESH SHANKAR For the Petitioner : - Mr. Vijay Kumar Roy, Advocate For the State :- Mr. Pankaj Kumar, A.P.P.

06/06.05.2020 The present revision petition is taken up through Audio/Video conferencing.

Heard learned counsel for the petitioner as well as the learned A.P.P. appearing on behalf of the State of Jharkhand (opposite party no.1).

Admit.

Issue notice to the opposite party no. 2.